The sale of a naked put is often a very attractive strategy that is conservative, can out-perform the market, can have a high-win rate, and can be analyzed and sometimes constructed in non-market hours. In this article, we’re going to look at some of the background on put writing, show a systematic way to select which puts are best to write, and finally explain how you can implement them into your trading arsenal “outside normal hours.”

The methodologies described herein are ones that I have confidence in, for they have produced profitable results in actual recommendations and in trading accounts that we manage over time. However, there may be other profitable approaches as well. I am not maintaining that this is the only way to analyze put writes – only that this is one viable way.

Option Selling is Conservative

The basic concept of option writing is a proven investment technique that is generally considered to be conservative. It can be implemented as “covered call writing” or, alternatively, “naked put writing” which is the equivalent strategy to covered call writing.

In either case, one is selling a wasting asset, and over time the cumulative effect of this selling will add return to a portfolio, as well as reducing the volatility of a purely equity portfolio.

People sometimes stay away from uncovered put writing because they hear that it is "too risky" or that it doesn't have a sufficient risk-reward. The truth is that put selling, when secured by cash, is actually less risky than owning stock outright and can out-perform the broad market and the covered-writing index over time.

Covered Writes vs. Naked Put Sales

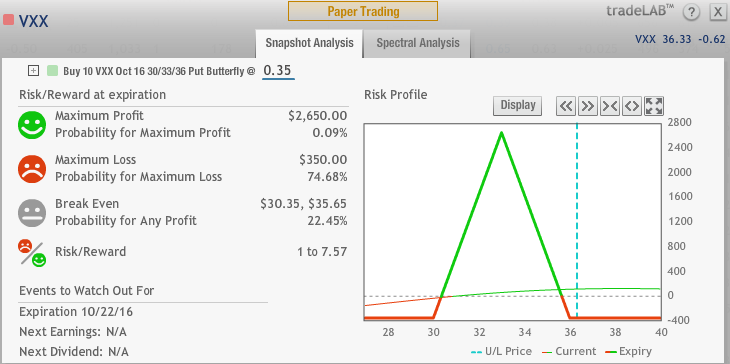

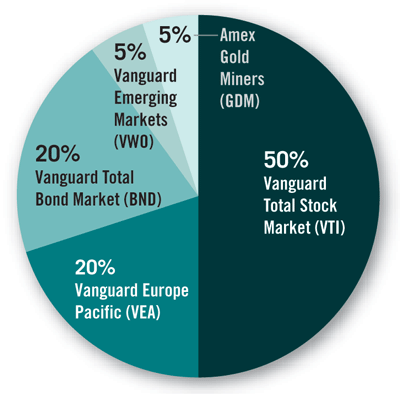

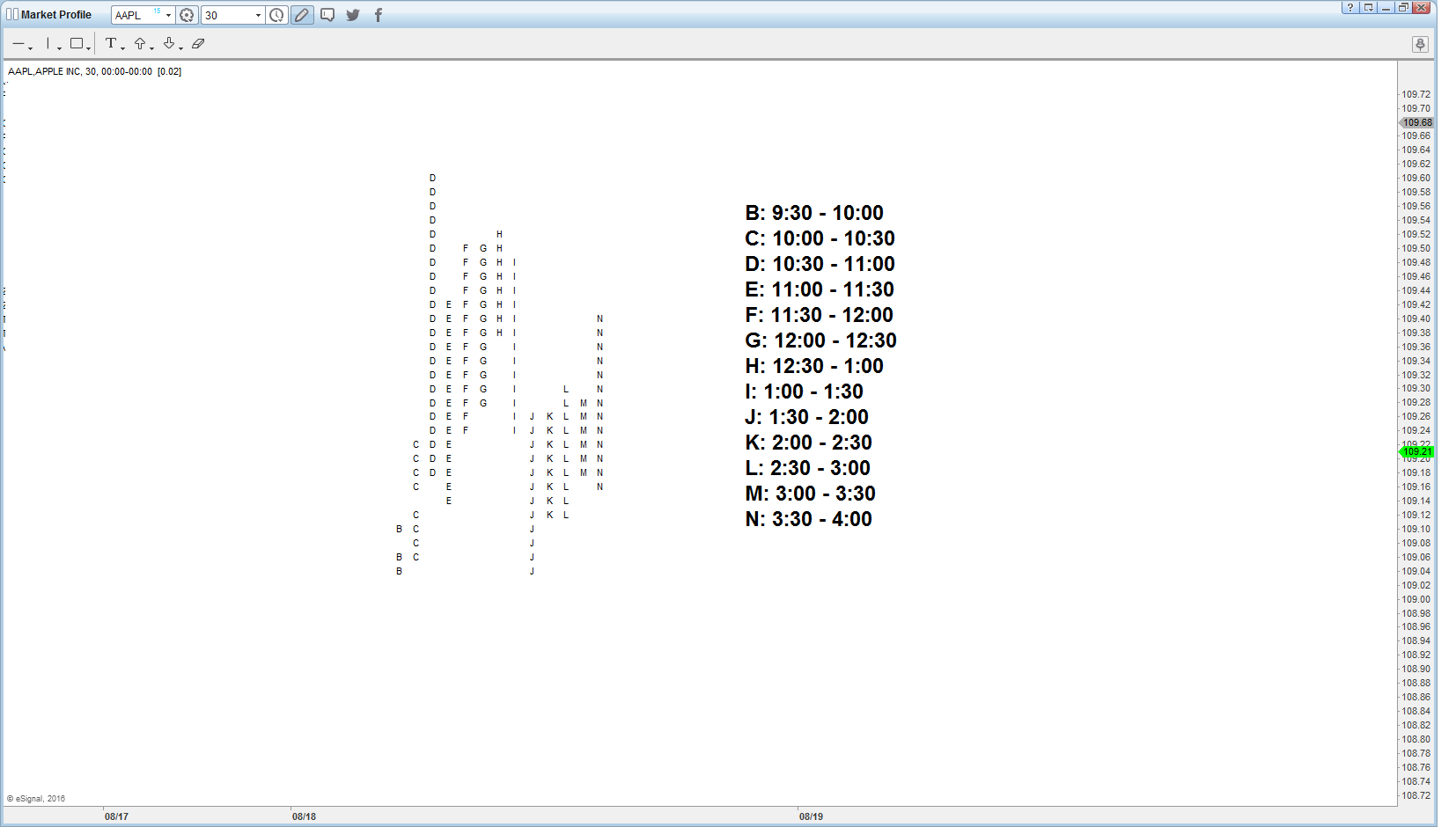

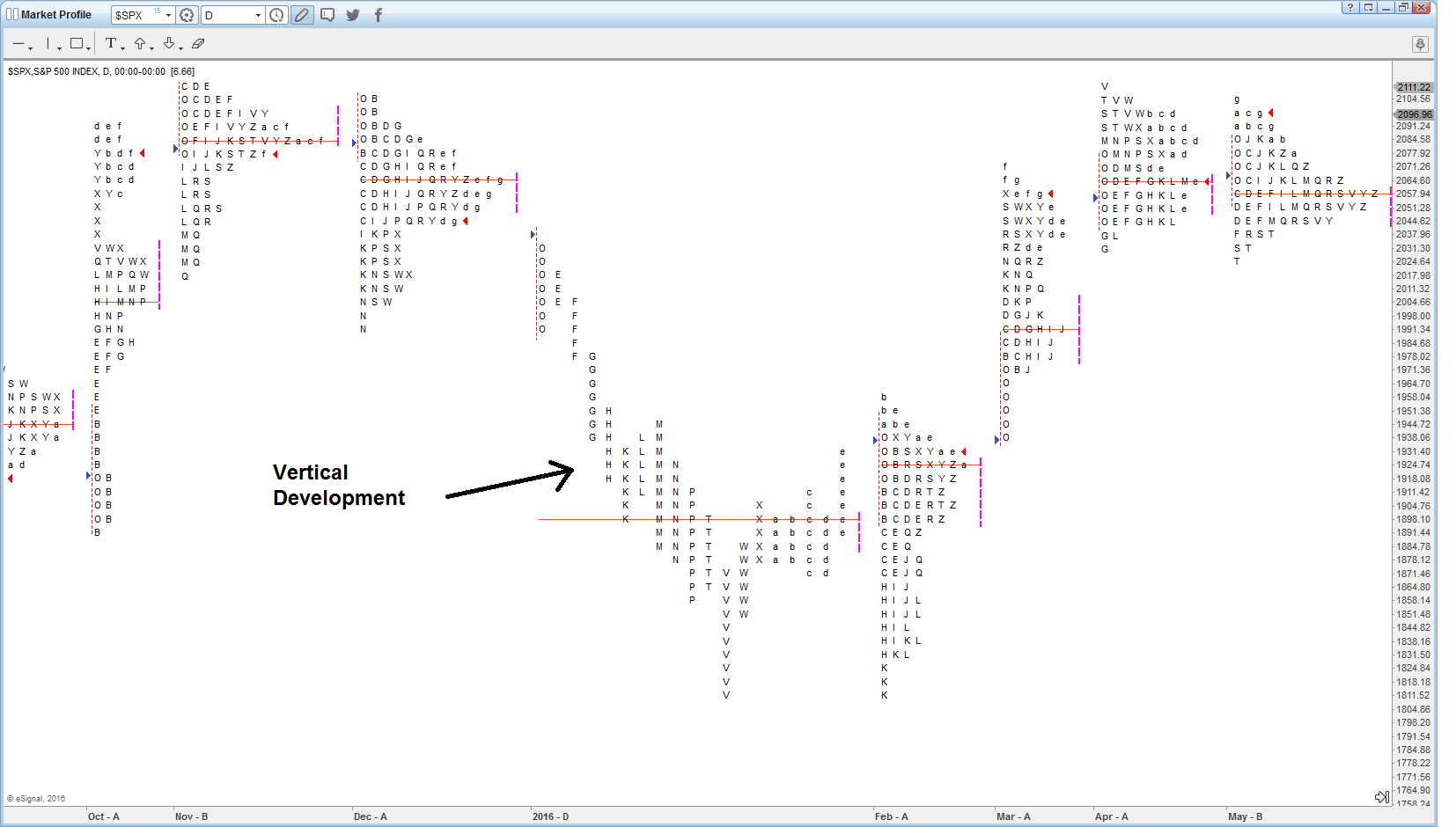

First of all, it should be understood that the two strategies – naked put writing and covered call writing – are equivalent. Two strategies are considered equivalent when their profit graphs have the same shape (Figure 1). In this case, both have fixed, limited upside profit potential above the striking price of the written option, and both have downside risk below the striking price of the written option.

FIGURE 1

One very compelling, yet simple argument in favor of naked put writing is this: commission costs are lower. A covered write entails two commissions (one for the stock, the other for the written call). A naked put requires only one. Furthermore, if the position attains its maximum profitability – as we would hope that it always does – there is another commission to sell the stock when it is called away. There is no such additional commission for the naked put; it merely expires worthless.

Nowadays, commission costs are small in deeply discounted accounts, but not everyone trades with deep discount brokers. Moreover, even there, it doesn’t hurt to save a few dollars here and there.

So, a naked put sale will have a higher expected return than a covered call write, merely because of reduced commission costs.

Another factor in utilizing naked puts is that it is easier to take a (partial) profit if one desires. This would normally happen with the stock well above the striking price and with a few days to a few weeks remaining before expiration. At that time, the put is (deeply) out of the money and will generally be trading actively, with a fairly tight market. In a covered call write, however, the call would be deeply in-the-money. Such calls have wide markets and virtually no trading volume.

Hence, it might be easy to buy back a written put for a nickel or less, to close down a position and eliminate further risk. But at the same time, it would be almost impossible to remove the deeply in-the-money covered call write for 5 or 10 cents over parity.

The same thinking applies to establishing the position, which we normally do with the stock well above the striking price of the written option. In such cases, the call is in-the-money – often fairly deeply – while the put is out-of-the-money. Thus the put market is often tighter and more liquid and might more easily be “middled” (i.e., traded between the bid and ask). Again, this potentially improves returns.

The above facts regarding naked put writing are generally known to most investors. However, many are writing in IRA or other retirement accounts, or they just feel more comfortable owning stock, and so they have been doing traditional covered call writing – buying stock and selling calls against it.

But it isn’t necessary, and it certainly isn’t efficient, to do so. A cash-based account (retirement account or merely a cash account) can write naked puts, as long as one has enough cash in the account to allow for potential assignment of the written put. Simply stated, one must have cash equal to the striking price times the number of puts sold (times $100, of course). Technically, the put premium can be applied against that requirement.

Most brokerage firms do allow cash-based naked put writing, however, some may not. Some firms may require that you obtain “level 2" option approval before doing so, but that is usually a simple matter of filling out some paperwork. If your brokerage does not allow cash-based putselling, you can always move the account to one that does, like Interactive Brokers.

Once you write a naked put in a cash account, your broker will “set aside” the appropriate amount of cash. You can’t withdraw that cash or use it to buy other securities – even money market funds.

Most put sellers operate in a margin account, however, using some leverage (if they wish). One of the advantages of writing naked puts on margin is that the writer can gain a fair amount of leverage and thus increase returns if he feels comfortable with the risk (as a result, we have long held that naked put writing on margin makes covered call writing on margin obsolete). That is not the case with cash-based naked put writing, though. The returns are more in line with traditional covered call writing.

In summary, put writing is our strategy of choice over covered call writing in most cases – whether cash-based or on margin. Later, when we discuss index put selling, you will see that there are even greater advantages to put writing on margin.

Put-Selling Can Outperform the Market

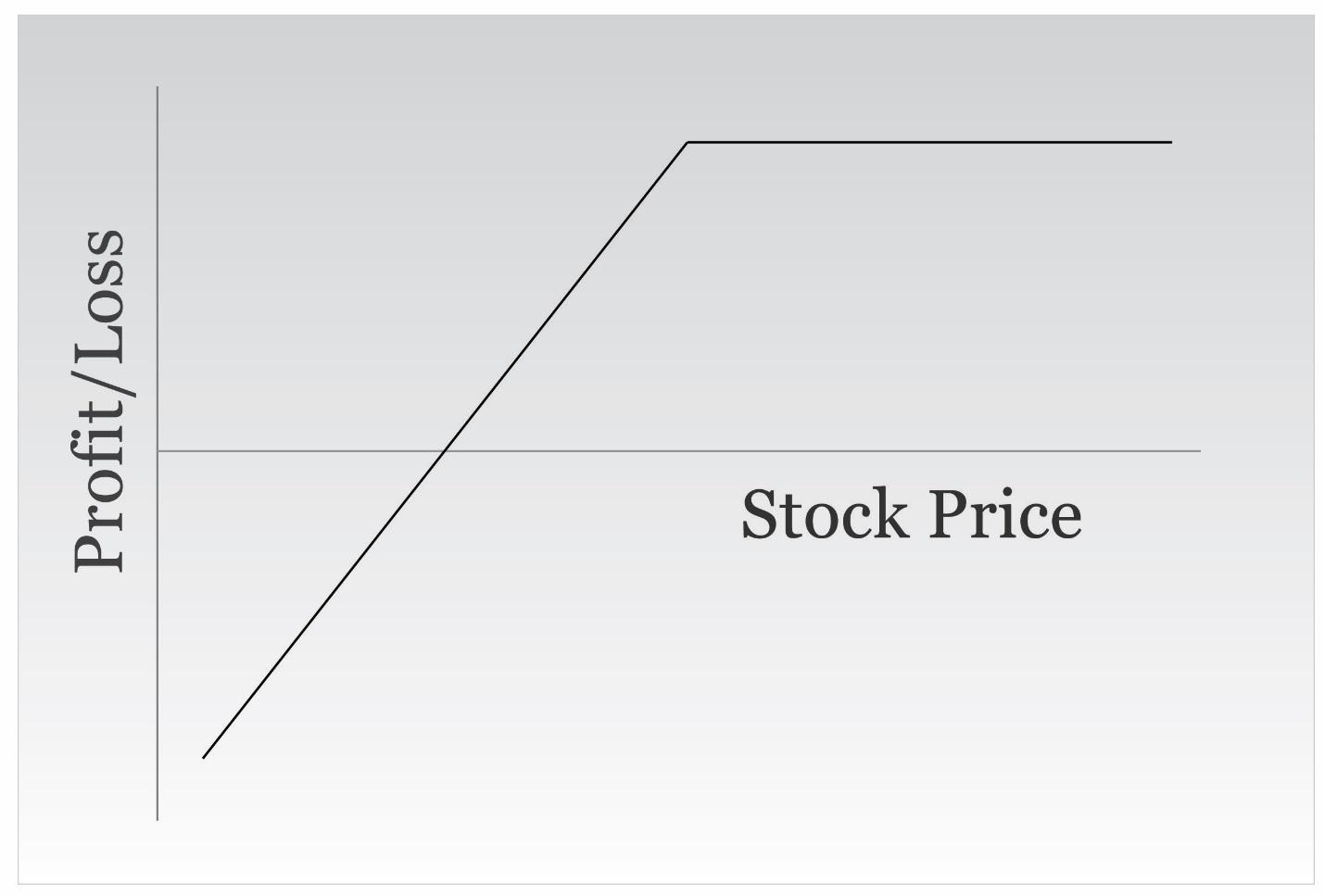

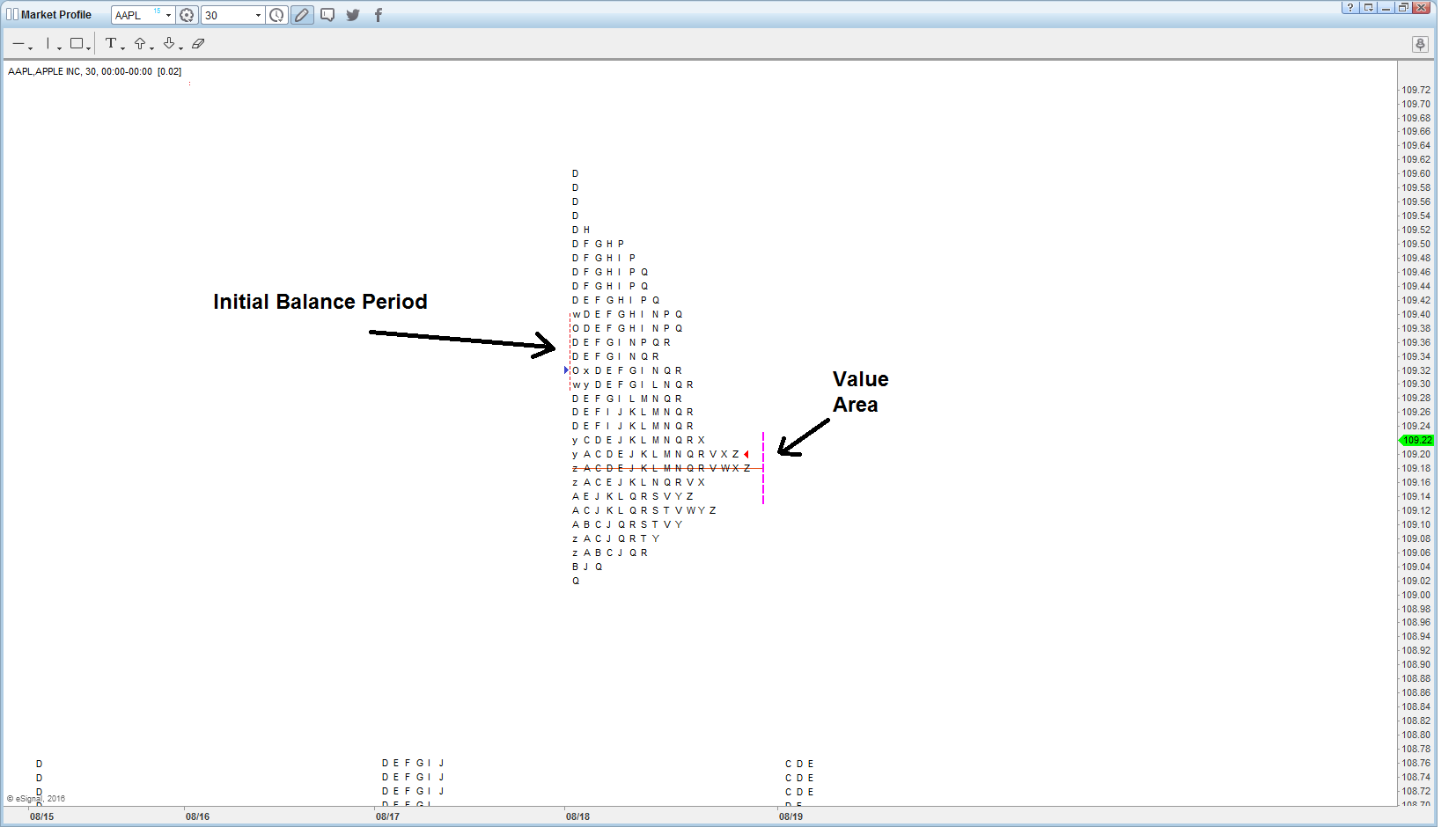

The Chicago Board Option Exchange (CBOE) has created certain benchmark indices so that investors can compare covered call writing ($BXM), naked put selling ($PUT), and the performance of the S&P 500 Index ($SPX). Figure 3 compares these indices, with all three aligned on June 1, 1988.

FIGURE 2

It is clear from the Figure 2 that naked put writing ($PUT) is the superior performer of these benchmark indices. For this reason, naked put writing is the preferred option-writing strategy that we employ in our newsletter services.

Since covered call writing is equivalent to naked put selling – and since Figure 2 merely shows dollars of profit, not returns – you might think that the covered call writing graph and the naked put writing graph would be quite similar.

But there is something more to index put writing – especially writing puts on the S&P 500 index ($SPX or SPY, or even e-mini S&P futures): out-of-the-money puts are far more expensive than out-of-the-money calls.

This is called a “volatility skew,” and it has been in effect since the Crash of ‘87. Institutional put buyers want to own $SPX (and related) puts for portfolio protection, and they don’t seem to care if they constantly pay too much for them. Conversely, other large institutions may be selling covered calls as protection, thereby depressing the prices of those calls. Some institutions do both – buy the puts and sell the calls (a collar). Thus, the main reason that $PUT outperforms $BXM by so much in Figure 3 is that the out-of-the-money puts being sold are far more expensive (in terms of implied volatility) than are any out-of-the-money calls being sold.

We recommend put ratio spreads and weekly option sales in The Daily Strategist newsletter as a way to take advantage of this. Moreover, we have put together a complete strategy – called Volatility Capture – that we use in our managed accounts.

In the Volatility Capture Strategy, we blend all aspects together to produce a reduced volatility strategy that can make money in all markets (although it will not keep pace on the upside in a roaring bull market). The primary focus of the strategy is selling $SPX puts, but there are two forms of protection in place as well.

McMillan Analysis Corp. is registered as both a Registered Investment Advisor (RIA) and as a Commodity Trading Advisor (CTA), so we are able to offer the strategy to both non-retirement and retirement accounts.

Our complete track record and other pertinent details are available by request. For preliminary information and a summary of our track record, visit our money management web site: https://www.mcmillanasset.com.

For more specific information, email us at the following address: [email protected], or call us at 800-768-1541.

Positions Can Be Hedged

One of the main arguments against put-selling is that the draw-downs can be large in severe market downturns. One way to mitigate these draw-downs would be to hedge the entire put-sale portfolio. For example, one may attempt to offset the market risk that is inherent to option writing by continually hedging with long positions in dynamic volatility-based call options as we do in our managed accounts.

This is really a topic for another article, but the gist of this protection is to buy out-of-the-money $VIX one-month calls and roll them over monthly. Buying longer-term $VIX calls does not work, for only the front-month contracts come anywhere close to simulating movements in $VIX (and in $SPX).

The Odds Can Be in Your Favor

As evidenced by the $PUT Index, naked put-writing is a conservative strategy that has the potential to out-perform the broad market over time. When implemented correctly, the strategy can have high rates of success and can also be hedged against large stock market-drawdown. For example, The Daily Strategist and Option Strategist Newsletters have produced a combined 89.4% and 85.6% winners in their index and equity naked put-selling/covered-writing trades since the newsletter started recommending them in May of 2007 and April of 2004 respectively. Investors looking for put-selling trading ideas and recommendations on a daily or weekly basis may be interested in subscribing to one of those services.

Trading Outside Normal Hours

Naked put-selling is an especially attractive strategy for do-it-yourself investors who do not have time in their day to watch the markets since positions do not need to be monitored closely all day. Put-writers can sit easy so long as the underlying stock remains above the strike price of the option sold. If the stock is above the strike price at expiration, the option simply expires. The option-seller then realizes the initial credit and no closing action needs to be taken. If the position needs to be exited early, usually due to the fact that the stock has dropped below the strike price of the short option, the position can be closed out automatically via a contingent stop loss order.

You cannot trade options outside of standard stock market hours; however, depending on your brokerage, you may be able to place your opening limit order outside the stock market hours. In this case, your order would simply be placed in a queue for processing once the market opened. If your broker doesn’t allow you to place an order outside market hours, you would only need a couple of minutes during the day to either call your broker or hop on your trading software to place your trade.

Another big benefit to naked put-selling is that it doesn’t take much analysis to find good potential trading candidates. In fact, as we do for our newsletters, all of the initial analysis can be done at night with computer scans and a little bit of discretion. The following section will discuss our approach to finding naked put-sale candidates for our newsletters each night.

Choosing What Put To Sell

For the most part, we choose our put-selling positions for our various publications based on data that is available on The Strategy Zone– a subscriber area of our web site consisting of various data scans and lists of potential trades compiled by our computer analysis. One could do the same sort of analysis yourself, as a subscriber to “the Zone.” On top of that, our Option Workbench provides additional analytical capability for that data.

Our computers do a lot of option theoretical analysis each night – from computer Greeks to analyzing which straddles to buy to graphs of put-call ratios. The Zone was started about 10 years ago, when I decided to make the outputs of our nightly programs available to anyone who was interested in paying a modest amount of money to view them. These analyses are still the basis for almost all of our recommendations.

Expected Return

Expected return is the crux of most of these analyses. For those of you not familiar with the concept, I will briefly explain it here.

Expected return is a logical way of analyzing diverse strategies, breaking them down to a single useful number. Expected return encompasses the volatility of the underlying instrument as a major factor. However, it is only a theoretical number and is not really a projection of how this individual trade will do. Rather, expected return is the return one could expect to make on a particular trade over a large number of trials.

For example, consider a fair die (i.e., one that is not “loaded”). There is an equal, one-sixth chance that any number will come up on a particular roll of the die. But does that mean if I roll the die six times, I will get one once, two once, three once, etc.? No, of course not. But if I roll the fair die 6 million times I will likely have rolled very nearly 1 million ones, 1 million twos, etc.

We are applying this same sort of theory to position analysis in the option market.

My Approach

For naked put selling, the first thing I look at is the file of the highest potential returns. These are determined strictly mathematically, using expected return analysis. This list is going to necessarily have a lot of “dangerous” stocks listed as the best covered writes. Typically, these would be biotech stocks or other event-driven small-cap stocks.

Next, I reduce the size of the list. I have a program that screens out a subset of these, limiting the list to stocks in the S&P 500 Index only. Individual investors might have other ways of screening the list.

If returns at the top of the list are “too good to be true,” then one can assume that either 1) there is a volatile event on the horizon (meaning the lognormal distribution assumption is wrong), or 2) the volatility assumption used in the expected return analysis is wrong. Throw out any such items. These would likely have annualized expected returns in excess of 100% – an unrealistic number for a naked put write. However, weekly put sales might sometimes be in that range. Those would have to be looked at separately. In general, if the underlying stock is going to report earnings during the week in question, the put sale should probably be avoided.

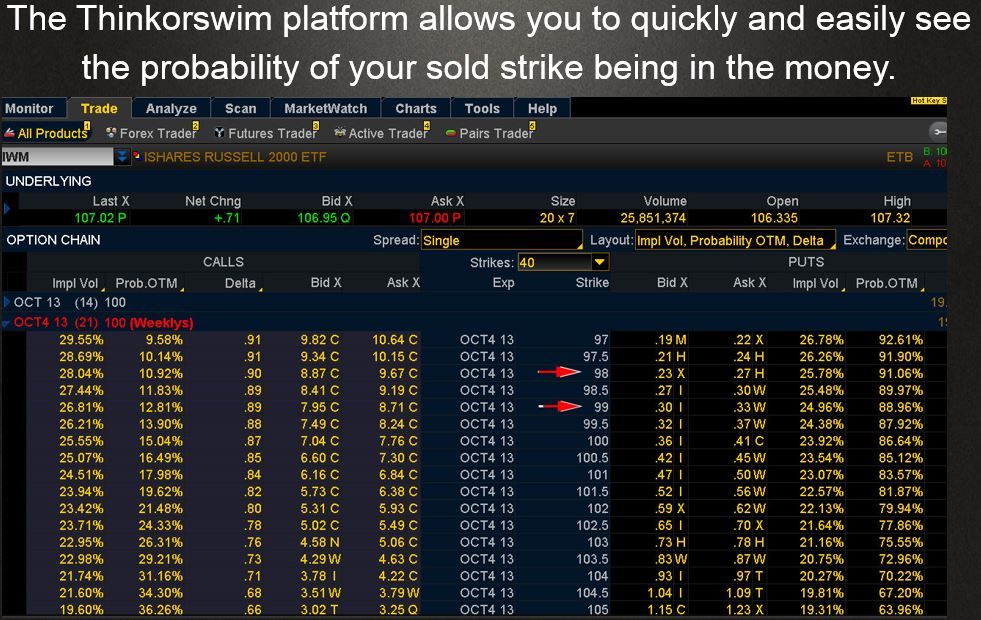

At this point, I select all the writes with annualized expected returns higher than 24% (my minimum return for writing puts on margin), and re-rank them by probability of profit. Once that is done, I select those with a probability of profit of 90% or higher, and re-rank them by annualized expected return. In other words, I am still interested in high returns, but I want ones with plenty of downside protection. This screening process knocks out most of the list, usually as much as 90% of the initial put writing candidates.

From there the analysis calls for some research, for at this point it is necessary to look at the individual stocks and options to see if there is something unusual or especially risky taking place. Some stocks seem to be on the list perennially – Sears (SHLD), for example, perennially has expensive options due to its penchant for drastic moves.

Another useful piece of information is the Percentile of Implied Volatility. That is listed in the data, and if it is low (below the 50th percentile), then I will likely not write that particular put. Recall that expected return needs a volatility estimate – and for these naked put writes we use the current composite implied volatility. However, if there is the possibility that volatility could increase a lot (i.e., if the current composite implied volatility is in a fairly low percentile), then there is a danger that actual stock movements could be much more volatile than we have projected. Hence, that is not a naked put that I would want to write.

I also look at the absolute price of the option. I realize that is taken into account in the expected return analysis, but I personally do not like writing naked options selling for only 20 cents or so, unless it’s on a very low-priced stock.

The expiration date of the option is important to me as well. I would prefer to write one- or two-month options, because there is less time for something to go wrong. Occasionally, if there is a special situation that I feel is overblown on the downside, I will look into writing longer-term options but that is fairly rare.

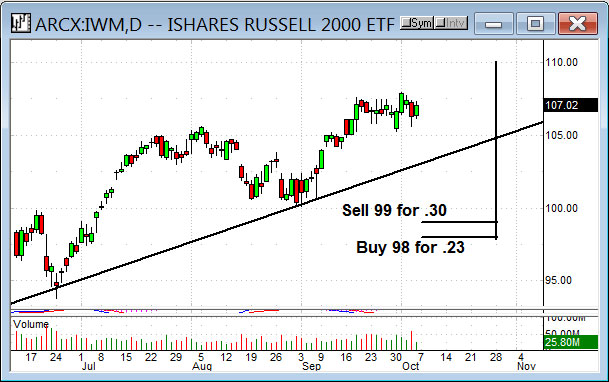

These further restrictions reduce the number of writing candidates down to a fairly manageable level. At this point, it is necessary to look at the individual charts of the stocks themselves. It’s not that I am trying to predict the stock price; I really don’t care what it does as long as it doesn’t plunge. Consequently, I would not be interested in writing a put on a stock, if that stock is in a steep downtrend. More likely, the chart can show where any previous declines have bottomed. I would prefer to see a support level on the chart, at a price higher than the striking price that I am considering writing. This last criterion knocks out a lot of the remaining candidates.

Some may say that the stock chart is irrelevant, if the statistical and other criteria are met. That’s probably true, but if I have my choice of one that has chart support above the strike and one that doesn’t, I am going with the one that does every time.

The potential put selling candidates that remain at this point are generally few, and are the best writing candidates. But I will always check the news regarding any potential write, just to see if there is something that I should know. By “news,” I mean earnings dates, any potential FDA hearing dates, ongoing lawsuits, etc. You can easily get a lot of this information by looking up the company on Yahoo Finance or other free financial news sites.

The reason that this news check is necessary is that these puts are statistically expensive for some reason. I’d like to know what that reason is, if possible. The previous screens will probably have weeded out any FDA hearing candidates, for their puts are so dramatically expensive that they would have alarm-raising, overly high expected returns.

But what about earnings? Studies show that the options on most stocks increase in implied volatility right before the earnings. In general this increase is modest – a 10% rise in implies, or so. But sometimes the rise is much more dramatic. Those more dramatic situations often show up on volatility skew lists and are used as dual calendar spreads in earnings-driven strategies. But as far as naked put writing goes, if the expected return on the put is extraordinary, then that is a warning flag.

If a position meets all of these criteria, we officially consider it acceptable to establish and may recommend it in a newsletter.

I realize that many put sellers (or covered call writers) use a different method: they pick a stock they “like” first, and then try to find an option to write. By this “fundamental” approach, one is probably writing an option that has a very low expected return – a la the calls on almost every “dividend stock” in the current market. They compensate for this by writing the call out of the money, so that they will have some profit if the stock rises and gets called away.

To me, that is completely the wrong way to go about it. If you like the stock, why not buy it and buy a put, so you have upside profit potential? What is the obsession with writing a covered call?

Rather than that “fundamental” or “gut” approach, the use of expected return as a guide to the position makes this a “total return” proposition – where we are not overly concerned with (upward) stock movement, but rather more concerned with the combination of option premium, stock volatility, rate of return, and probability of winning. To me, that is the correct approach.

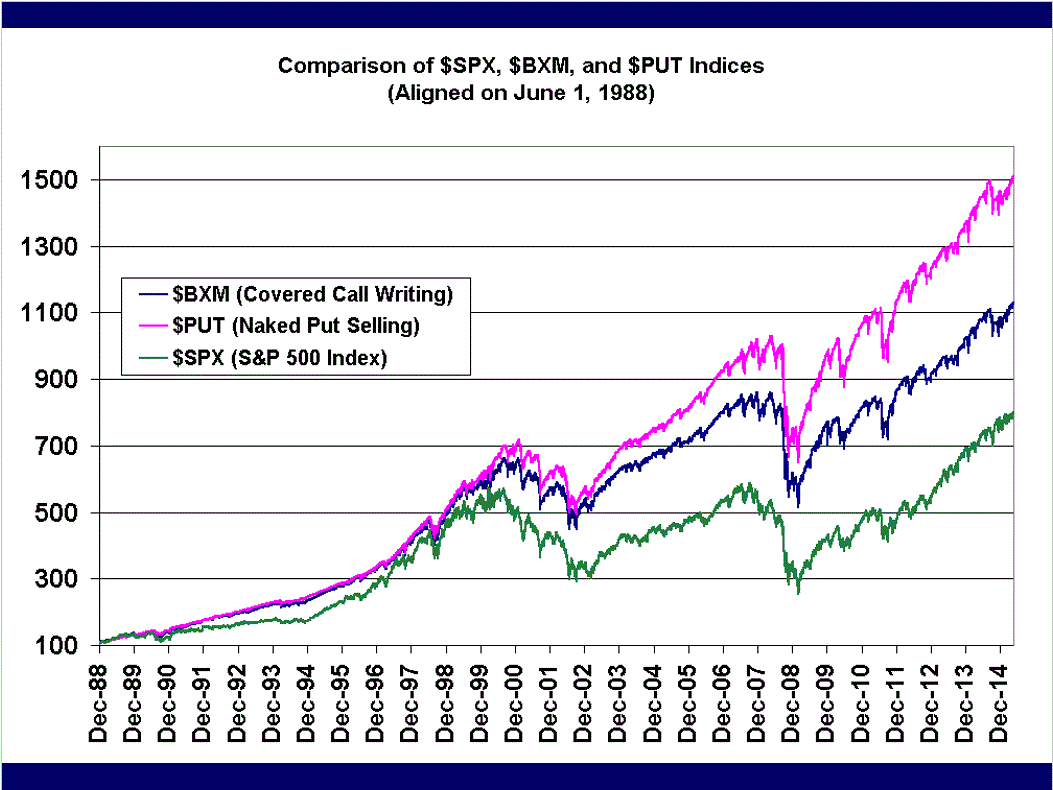

Selecting Naked Put Writes From OWB

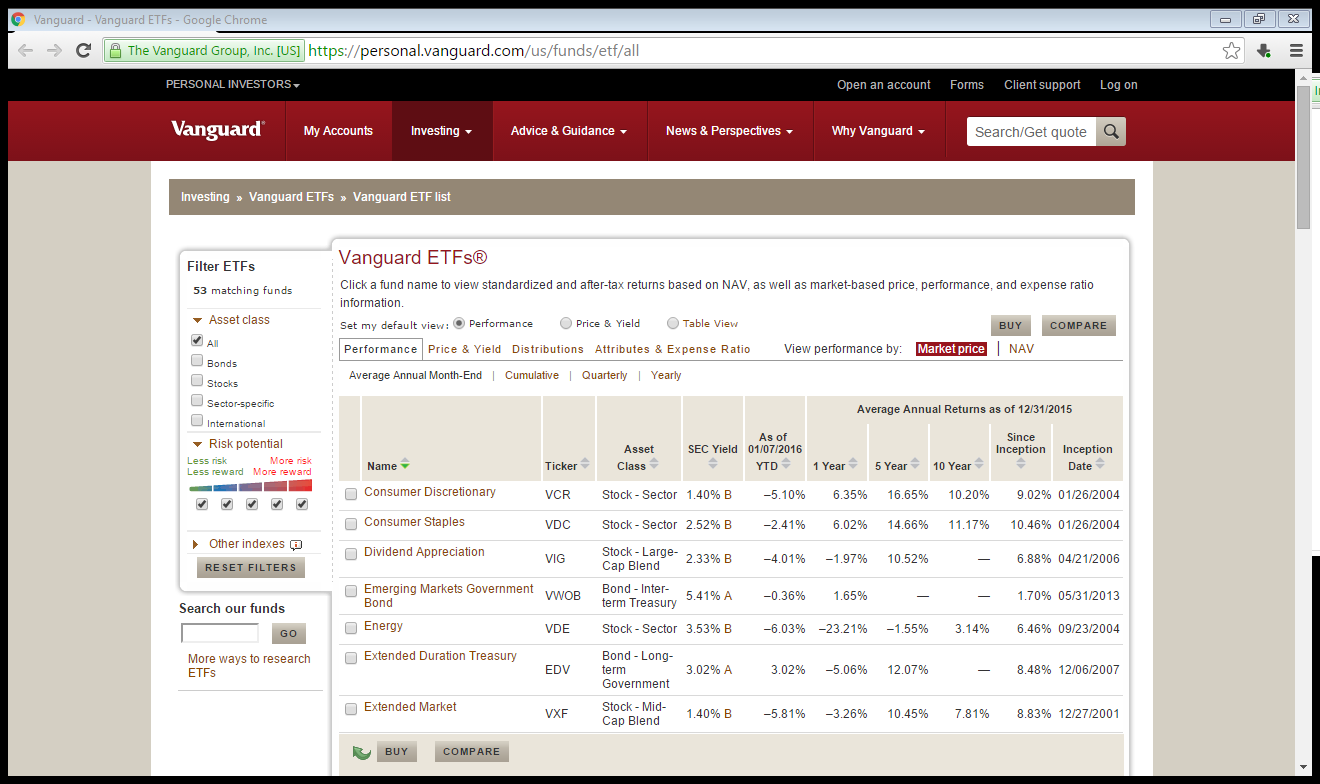

Option workbench makes finding actionable naked put-sale trades that fit all of the criteria in my aforementioned approach quite easy. Once you are logged into the software, one would first access the “broad” scan of potential candidates by hovering over “Spread Profiles” and clicking on Naked Puts.

A list of all the naked put writes that have annualized expected returns of greater than 4% will be shown (that 4% threshold would move higher if T-Bills ever yield anything besides 0%!).

Using the closing data from June 17, 2015, there were 14,449 such put writes! Obviously, one has to cut that list down to a more workable size.

There are a lot of 32 column headings here, and most are statistical in nature. To me, the two most important pieces of data are 1) annualized expected return, and 2) downside protection (in terms of probability – not percent of stock price). Both of these are volatility-related, and that is what is important in choosing put writes. You want to ensure that you are being compensated adequately for the volatility of the stock.

If you click on “A Exp Rtn” (which is Annualized Expected Return), the list quickly sorts by that data. However, in my opinion, it is not a good idea to just sell the put with the highest expected return. The computer calculations make certain assumptions that might not reflect the real world. For example, if there is a large possibility that the stock might gap downwards (an upcoming earnings report, for example), the puts will appear to be overly expensive. Any sort of upcoming news that might cause the stock to gap will raise the price of the puts. You probably don’t want to write such puts, even though the computer may “think” they are the best writes to establish.

In order to overcome these frailties, one would use the “Filter Editor” function of OWB. You can construct a filter to include or exclude writes that do/don’t meet your individual criteria.

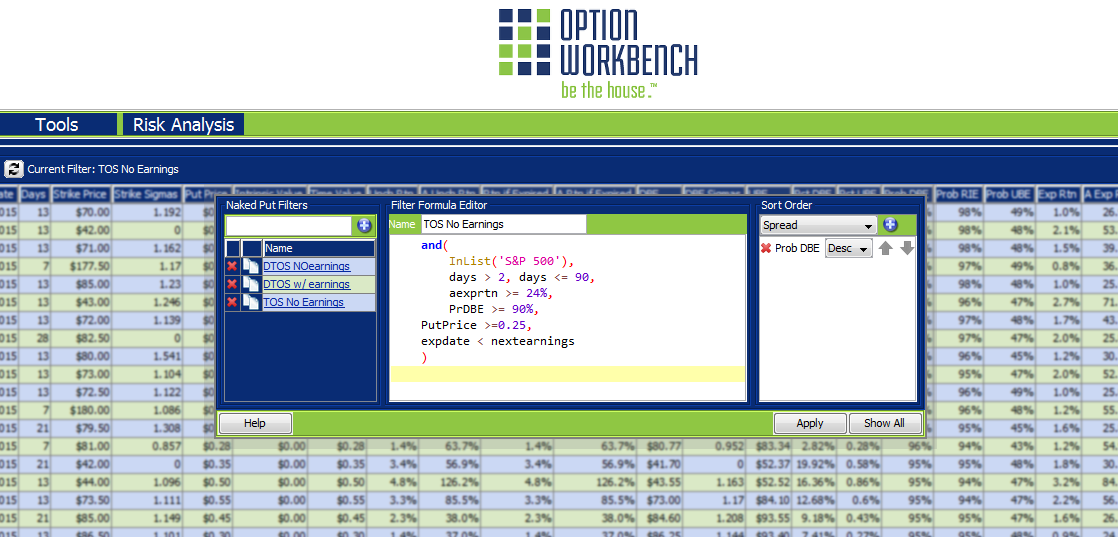

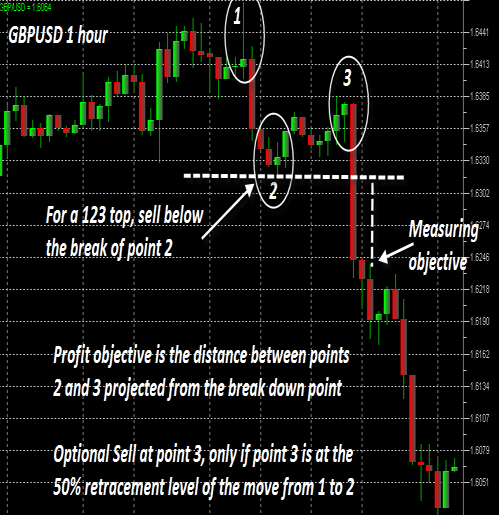

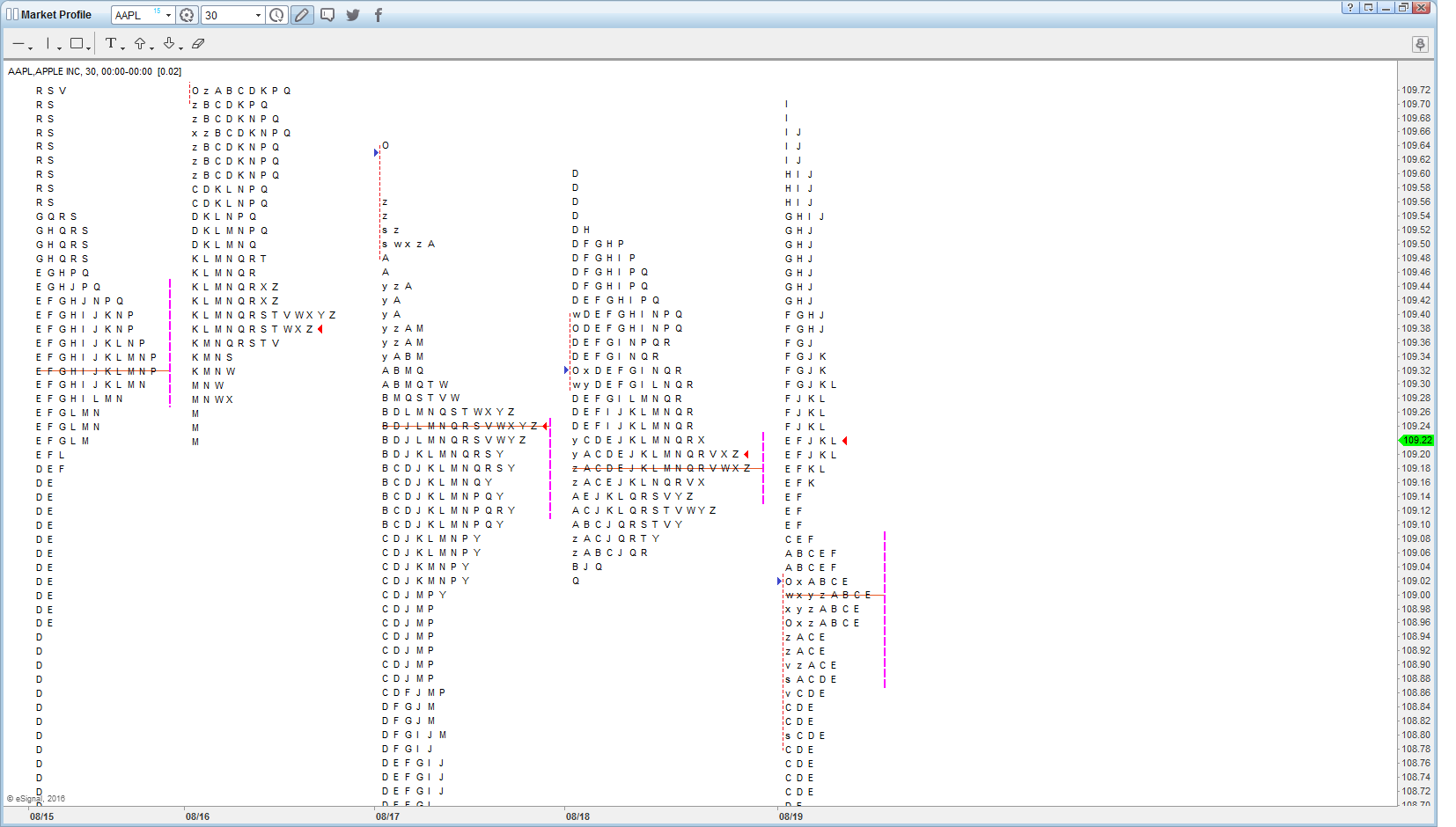

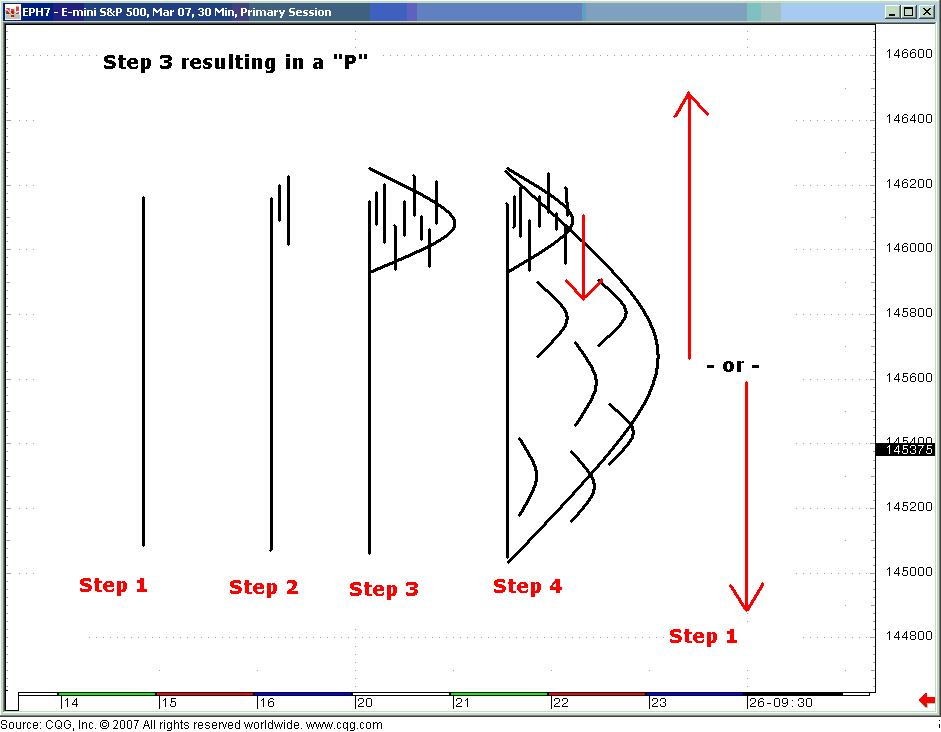

Figure 3

If you click on the button (above the data) that says “Profile Filter Editor,” a box will appear. Figure 3 shows the box as it appears in my version of OWB. On the left are three filter names: DTOS Noearnings, DTOS w/ earnings, and TOS No Earnings (mine). In the center of Figure 3, the actual formulae for the filter “TOS No Earnings" are shown.

To apply the formulae, merely click the “Apply” button (lower right of Figure 3). In this case, the list of 14,449 potential naked put writes shrinks to 64 candidates!

Here are the formula that appear in Figure 3:

InList (‘S&P 500'): include only stocks that are in the $SPX Index. This way, we are not dealing with extremely small stocks that can easily gap by huge amounts on corporate news.

Days>2, days <= 90: include only writes whose expiration date is between 2 and 89 days hence.

Aexprtn >= 24%: only include writes whose annualized expected return is at least 24%

PrDBE >= 90%: only consider stocks that have less than a 10% chance of being below the downside breakeven (DBE) point at expiration.

PutPrice >= 0.25: only consider puts that are selling for at least 0.25.

expdate < nextearnings: only consider put sales on stocks that are not going to report earnings while the put sale is in place. Stocks are far too volatile on earnings announcements, and this will avoid the main cause of downside gaps: poor earnings.

These criteria produce a strong list of put writing candidates. There will be no earnings announcements to cause downside gaps. There is a 90% chance of making money. Over time, writes such as these should produce returns in line with the expected returns – greater than 24%, using this formula.

You can add many other filters (or delete some of these if you wish). It is easy to do within OWB, and I encourage you to experiment with it.

Once the list has been filtered, there is still work to do. Why are these remaining puts so expensive? One might have to look at the news for certain stocks to see why. At the current time, health care stocks have very expensive options: ET, HUM, THC, for example. Not only are these inflated because of takeover rumors, there is also supposedly some Medicare-related pricing edicts coming soon from the U.S. Government. Those things could cause downside volatility; however, one may feel there is enough downside protection to warrant selling the puts. If that were the case, you would have found your trade!

Placing Your Trade

After you have found your trade the next step would be to determine how many puts to sell. Generally, for a margin account, most brokerages have a margin requirement of 25% of the strike-price of the short put you are selling less the premium received for the sale of the put less the out-of-the-money amount, subject to a 10% minimum. We generally write out-of-the-money puts and set aside enough margin so that the stock has room to fall to the striking price – the level where we generally would be closing the position out. This conservative approach decreases the risk of a margin call if the stock moves against your position.

For example, if you sell a naked put with a strike price of 50 for a credit of 1.00, the margin we would set aside would be $1,150. The formula below illustrates this:

Strike Price (50) x 25% (0.25) x Shares per Option (100) – Premium Received (100) = Margin Requirement ($1,150)

For cash accounts, one would have to set aside 100% of the strike price less the put premium. So, for the prior example, the cash collateral would be $4,900 (50 x 100 – 100).

We generally suggest that one puts no more than 5% of their total portfolio value in any particular put-sale for margin accounts, and 10% for cash accounts.

If you had a $100,000 margin account, you would want to allocate no more than $5,000 to any particular put sale. Using the prior example, you would then sell 4 naked puts ($5,000 / $1,150 = 4.35). Cash based accounts would sell 2 contracts (($100,000 x 0.10) / $4,900 = 2.04).

The next step would be determine your stop. Generally, we like to set our stops at the downside break-even level at expiration. This level can easily be calculated with the following formula:

Strike Price – Put Premium = Downside Break-Even Level

However, if you cannot watch your position throughout the day, it may make sense to set your intraday stop at the strike price. This means that if the stock trades below the strike price you are short, the position would be automatically closed. That way, there would be no risk of assignment if the stock were below your strike at expiration.

Now that you have determined your quantity and stop, the final steps would be to enter your order (before the open with your brokerage’s order queue if possible), set your stop (via a contingent stop order if your brokerage allows) and monitor. Those who cannot generally participate during normal market hours and whose brokerages don’t allow order queuing and contingent stops, would only need a few minutes to initially place the trade. Furthermore, they would only have to monitor the trade near the market close each day to see if the stock is below their stop. If it were, one would simply buy back the put to close the position.

THE MOVIE

Do-It-Yourself with Option Workbench

Those looking to analyze potential naked put-writes themselves, can do so with ease with our Option WorkBench (OWB).

This is the overlay service to our Strategy Zone, and it provides the ability to sort the reports in various ways. More importantly, it allows one to construct his own analysis formulae.

For information on the various features and capabilities of OWB, WATCH THIS VIDEO HERE!

THE SPECIAL OFFER

Find naked put-sale candidates on your own with a free 30-day trial to Option Workbench. Feel free to use my filter or create one of your own!

Scroll to the bottom and select the one month subscription ($135) and enter the Coupon Code FREEOWB at checkout. No credit card is required. Subscription will not automatically renew upon completion.

CLICK HERE TO SUBSCRIBE!

ABOUT THE AUTHOR

Lawrence G. McMillan is the President of McMillan Asset Management and McMillan Analysis Corporation, which he founded in 1991. He is perhaps most well-known as the author of Options As a Strategic Investment, the best-selling work on stock and index options strategies. The book – initially published in 1980 – is currently in its fifth edition and is a staple on the desks of many professional option traders.

His career has taken two simultaneous paths – one as a professional trader and money manager, and the other as an educator and proponent of using option strategies.

In these capacities, he currently authors and publishes "The Option Strategist," a derivative products newsletter covering options and futures, now in its 24th year of publication. His firm also edits and publishes three daily newsletters, as well as option letters for Dow Jones. He has spoken on option strategies at many seminars and colloquia, and also occasionally writes for and is quoted in financial publications regarding option trading.

Mr. McMillan is the recipient of the prestigious Sullivan Award for 2011, awarded by the Options Industry Council in recognition of his contributions to the Options Industry.