Chapter

01

6 Key "Market Based" Inputs

By Mike Ryske, NetPicks.com

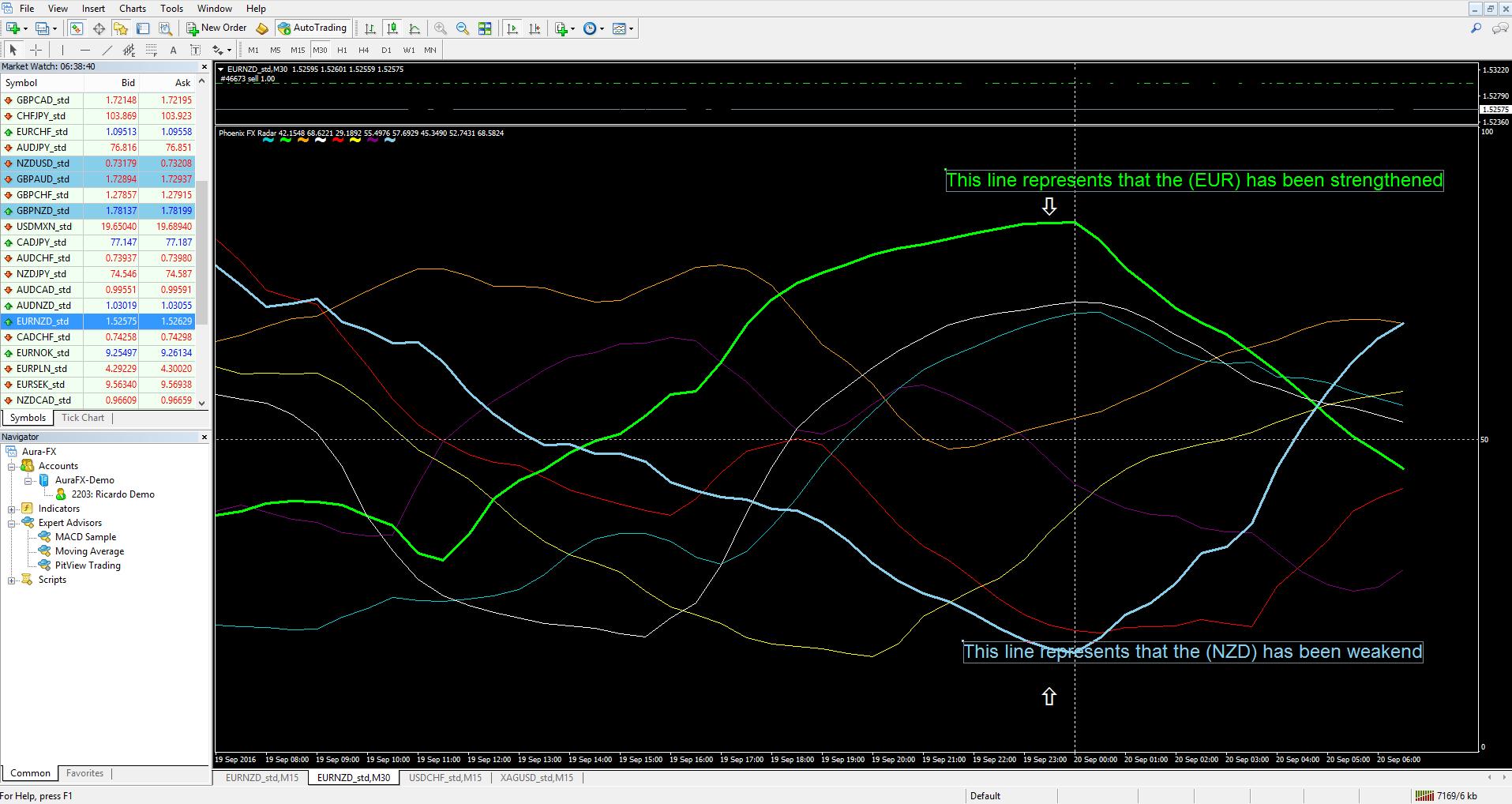

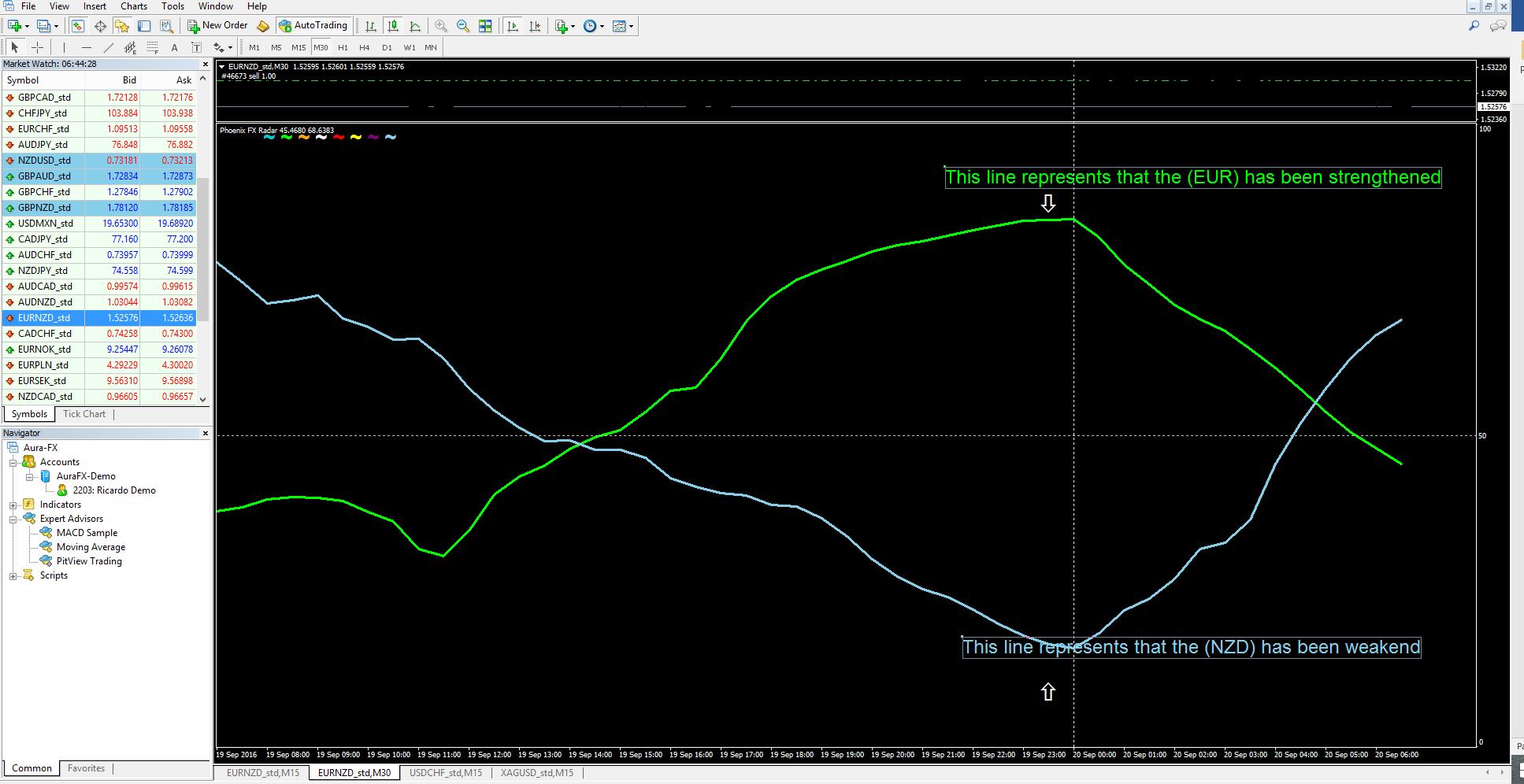

When most of us hear the phrase “indicator”, we usually think about technical indicators like Moving Averages (EMA and SMA), the Relative Strength Index (RSI), Stochastics, and the MACD (among others). And while these may be effective in helping to determine the direction a market is moving in - or where to enter and exit a trade – they are not always helpful when make decisions on placing an options trade. This requires more of an understanding of market based indicators, or as I like to call them, the 6 key inputs that drive the options pricing model.

If you are a trader or investor you can probably remember back to when you first got introduced to the markets. “Buy low / sell high.” “Invest for the long term in companies that you know and understand and who have good fundamentals.” These are some of the common methodologies taught in business schools and promoted by financial planners. As a result, in many cases, traders go into trading options with the same approach. Buying long calls and puts as a way to play the markets moving up or down is a common starting point. The problem with this approach is that buying long calls or puts is much different than buying or selling shares of stock. The prices of these options are influenced by other factors than just stock direction. Understanding how these different factors influence the price of an option can really help you improve your trading results in the long run.

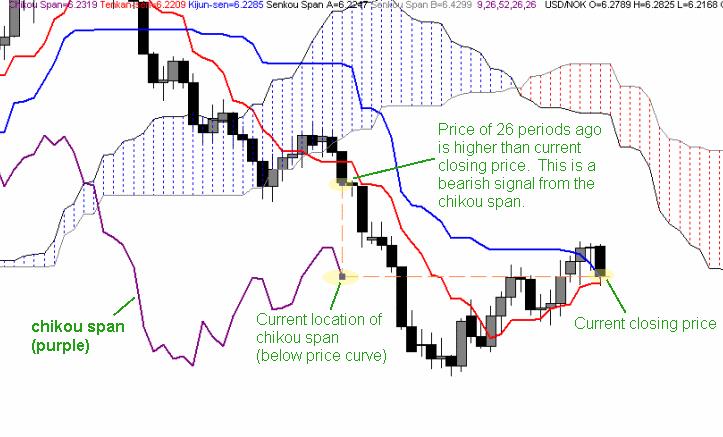

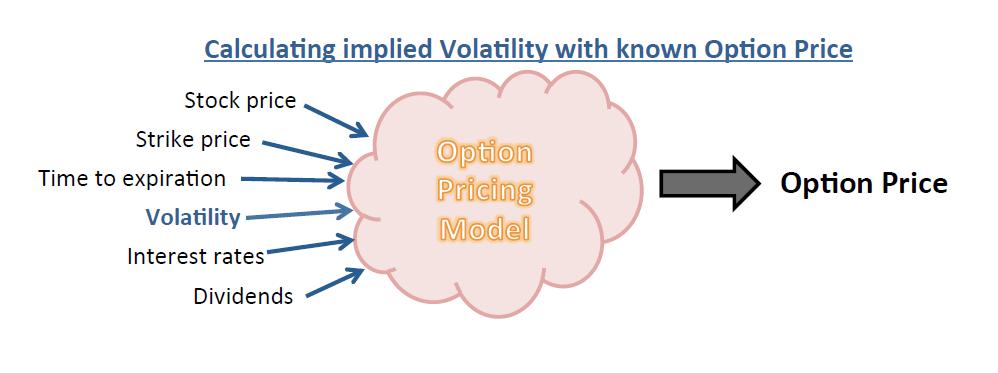

The option pricing model actually has 6 different inputs which can influence the movement in your options. While stock price is a big input in the price of an option, there are other factors in play that are crucial to understand if you desire to see success with your trading. The 6 inputs in the pricing model of an option are Stock Price, Strike Price, Time to Expiration, Volatility, Interest Rates and Dividends. We are going to talk about Volatility and Time to Expiration in more detail as these two can cause the biggest issues with the way many retail traders use options.

Of the 6 inputs that go into the option pricing model, 5 can be easily determined. Stock price, strike price, time to expiration, interest rates, and dividends are easily found. The one wild card is volatility, as it is constantly changing throughout each trading session.

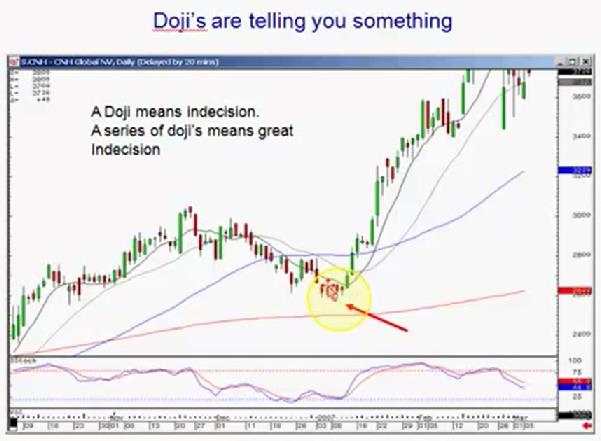

The pricing model actually works backwards to determine which level of volatility is being used to generate the current price of an option. It takes the 5 known inputs and backs them out of the current option price being quoted to get the volatility. This is known as Implied Volatility. In order to trade options successfully it’s important to understand when Implied Volatility is high or low for each product that you trade. If you don’t understand volatility, then you could potentially see a directional move in your favor and still not make money. This would happen if you were long a call option and got a move higher in the stock but a drop in implied volatility. This could result in a lower profit return or even worse no profit at all.

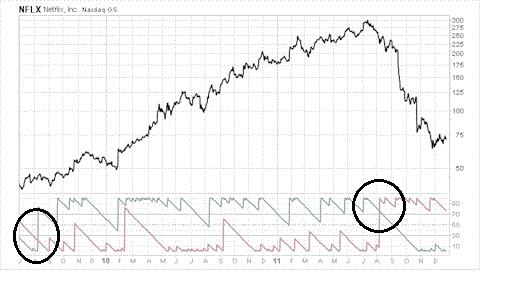

We teach our students to let the markets determine which options we decide to trade. What we mean here is we want to buy options when volatility is low and sell them when it’s high. How do we know what’s high and what’s low when it comes to volatility? The way we do it in the Thinkorswim platform is to use the IV Percentile tool. This can be found on the trade page under the ‘Today’s Options Statistics’ box towards the bottom of the trade page. This number compares the current level of Implied Volatility being used to the levels of volatility that have been seen on that product over the last 52 weeks. Anything above the 50th Percentile means Implied Volatility is high while any reading below the 50th Percentile means Implied Volatility is low.

The reason we like to let volatility guide us is we are taking the view that over time the 50th Percentile will act as a magnet and will pull volatility towards it. When the volatility is high we will go to the premium collection strategies in our playbook. This includes selling vertical spreads which is one of our favorite strategies. When Implied Volatility is high and we sell premium we are actually increasing our odds of success if volatility drops. This happens because as volatility drops the options will get cheaper, which will allow us to close our short premium trades for more profit. It’s giving us more ways of being profitable.

When Implied Volatility is below the 50th Percentile we will focus on buying premium. This is the case because if we get volatility to expand higher towards the 50th Percentile that will actually help our options increase in value faster.

If you can program yourself to follow volatility closely you will vastly increase your chances of success. Instead of just buying a long call or put on each trade and hoping for the best, you will actually give yourself a better opportunity to make money if the market doesn’t do exactly what you are looking for.

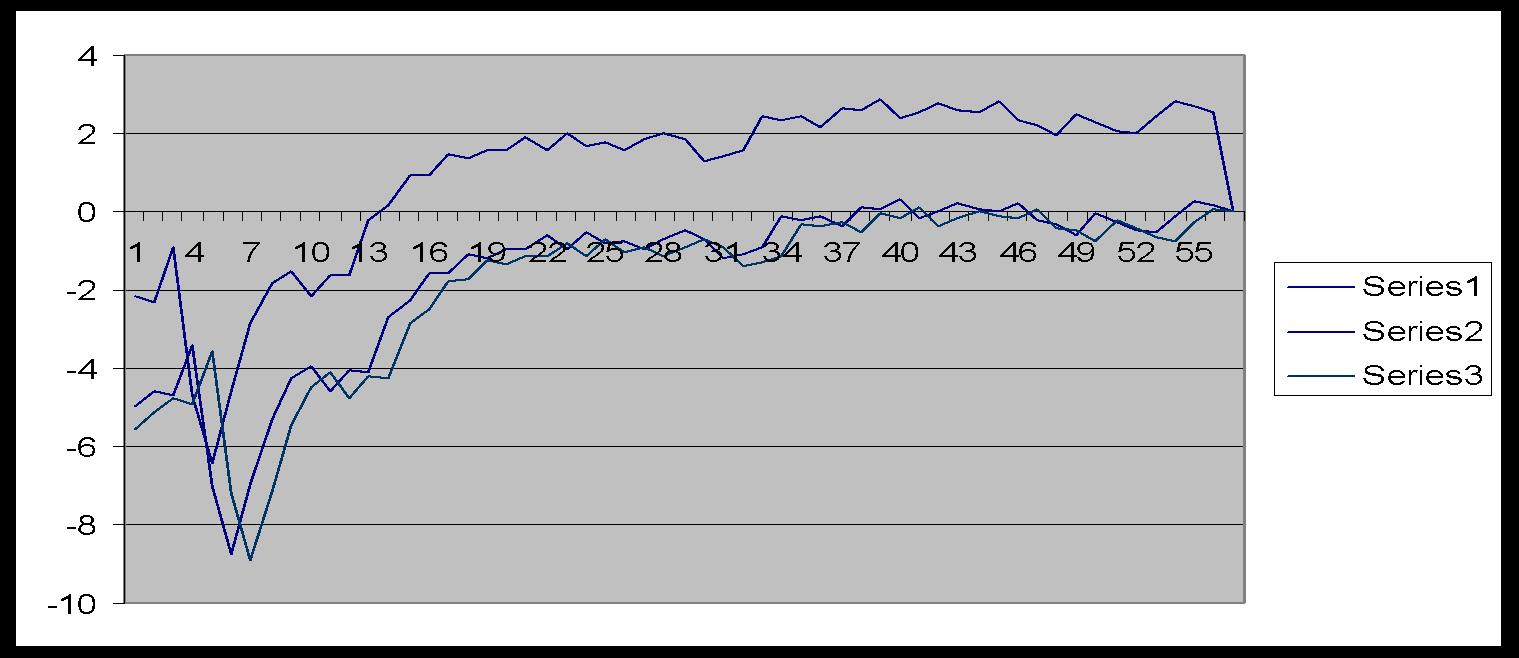

The second input in the options pricing model that many options traders don’t pay enough attention to is Time to Expiration. We know that trading options is much like buying an insurance policy. Each day that we don’t make a claim our policy loses value that we don’t get back. Trading options is much the same way. The longer you hold an option the less value it will have due to the time decay. You can actually limit the effect of time decay by going farther out in time. This is due to the fact that time decay moves in a nonlinear fashion. In other words, the closer you get to expiration the more value the option will lose each day that you hold it.

Knowing this about time decay means we can place trades with better odds of success by going farther out in time. Many traders will look to the weekly options which expire each Friday because they are very inexpensive when compared to the options that expire once a month. However, when trading the weekly options you have to understand the time decay can have a big factor on your trades. Instead of putting on trades that don’t have a large margin for error, I encourage our students to go out 20-40 days at a minimum. This will limit some of the effect of time decay and will allow you to hold your positions longer without the time decay eating away at those positions.

If just blindly buying calls and puts, you are going to face an uphill battle over time with your options trading. Sure you will have some really great winners from time to time but ignoring factors like Implied Volatility and Time Decay will ultimately lead to frustration. It will be hard for you to hit the consistent profits that we all want over time. However, flip the cards around and let these factors work in your favor and I think you will be amazed at how the growth in your account will improve.

3 Options Strategies for More Profits

Long Call or Put

When buying a long call or put, we need to make sure we have a strong opinion on which way the stock or ETF is headed in the near term. We have to keep in mind that whenever we buy an option the clock is ticking the second we decide to initiate the trade. The time decay will start to add up and potentially eat into the profit potential that we have. This means not only do we need to be right on market direction, but the move needs to happen in our favor quick enough.

To combat some of the negative features of buying an option, we like to be very picky with the criteria that we use when selecting the call or put option. First, we don’t pick the option based on what we can afford like so many retail traders make the mistake of doing. In many cases, this will leave you with an out of the money option which has a very low probability of success. Instead, we like to trade the in the money options.

Our criteria has us going out 20-40 days until expiration and buying the call or put option that is 1-2 strikes in the money. This criterion is the same whether we are trading AAPL, BA, or C. By using the same criteria on all stocks and ETF’s, we are able to take much of the discretionary decisions out of the equation.

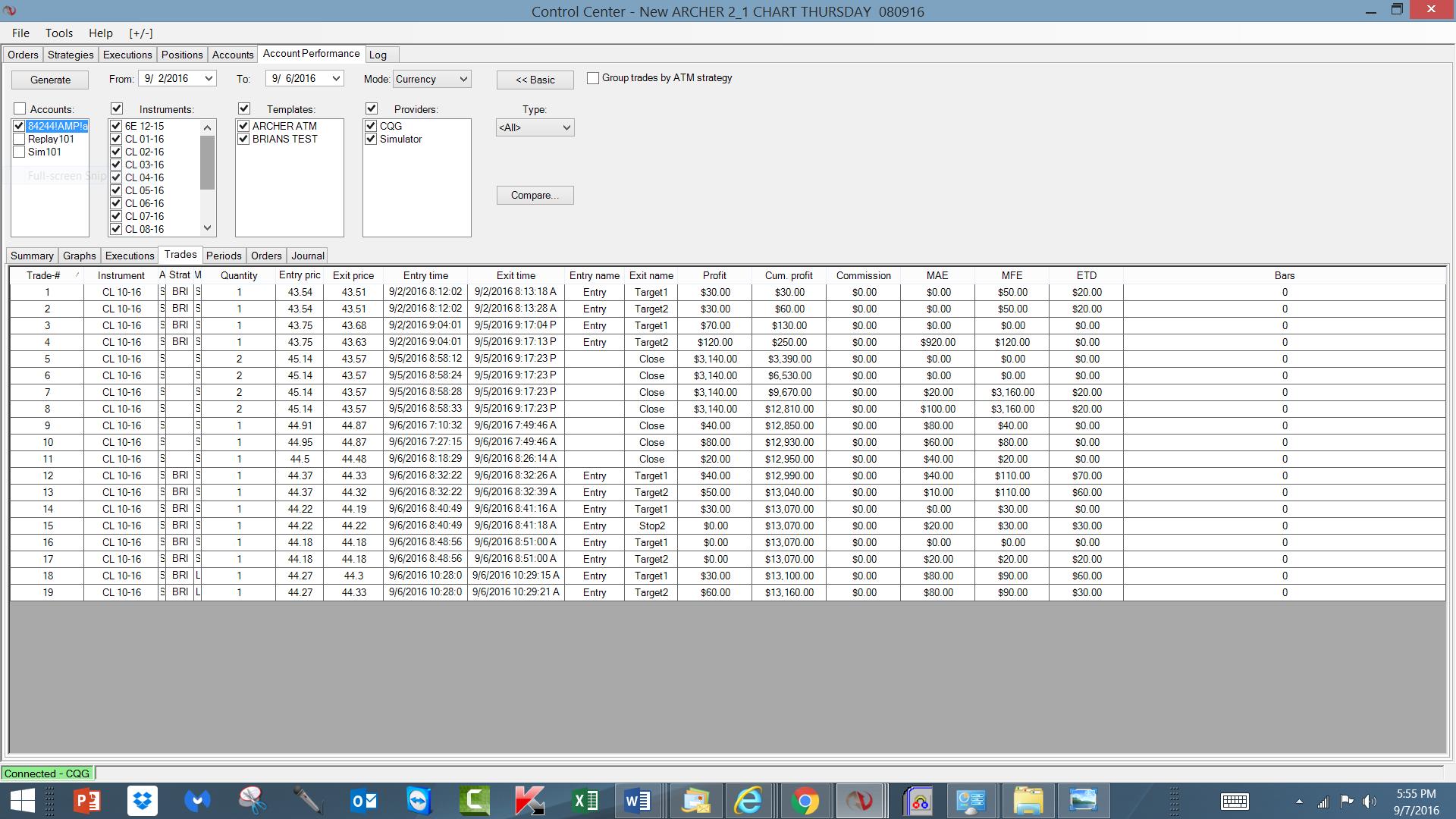

For example, back in June our Options Fast Track system gave us a long setup on one of the volatility ETF’s (Symbol: VXX). The entry point was at $14.15 on the chart. Instead of tying up the capital buying the shares of stock once the entry point was hit, we decided to buy the July 13 call options for $1.93 or $193 per contract. The options had between 20-40 days left until expiration and the 13 calls were one strike in the money from the entry point.

For less than $200 we were controlling 100 shares of stock with the call option. This is a perfect example of the leverage that options offer us. Regardless of the account size you are working with, this is a trade that will leave you with very little capital at risk.

We were fortunate enough in this case that VXX did go up and hit our full target at $16.67. Once this level was hit, we sold out of the long call position for $4.00 per contract. This gave us a profit of $207 per contract or a return of 107%. That’s a great profit that can give a quick boost to a small account.

Long Vertical Spread

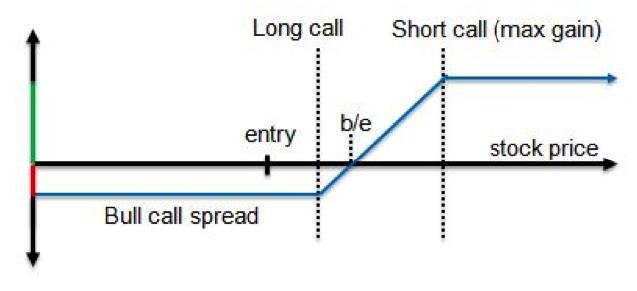

There are times when I want to make a directional bet but do so with a more conservative trade. This is where the long vertical spread comes in. Out of all trade types, the Vertical Spread is my favorite as it is the most flexible strategy when it comes to trading options. When using a long vertical spread, we still need to have a strong opinion on which way the stock or ETF is heading in the near term. While the time decay is still going to be there like with a long call or put, the long vertical spread is able to limit the effect of that time decay slightly.

We like to use the long vertical spread when we are less sure of market direction. We are able to do this because a long spread is constructed by both buying an option and selling an option with a different strike at the same time. Vertical spreads offer a unique ability to control risk and reward by allowing us to determine our maximum gain, maximum loss, breakeven price, maximum return on capital, and the odds of having a winning trade, all at the time we open a position.

When setting up a long vertical spread we still like to trade the options that have between 20-40 days left until expiration. We structure the trade by always buying the option that is 1 strike in the money and then selling the strike that is closest to our target for that stock or ETF in the near term. The nice part about using this simple criteria is that it is the same when using call or put options. The criteria is also the same regardless of the symbol of the stock we are trading.

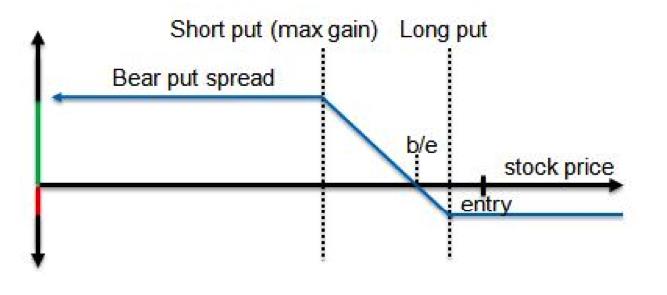

For example, back in June we had our Options Fast Track system giving us a short setup on Tesla (Symbol: TSLA) with an entry point at $227.98. Instead of going in and short selling the shares of stock, which could tie up thousands of dollars or capital, we decided to look at trading the options.

Buying a long put option is one way of playing the market when it is moving to the downside, but it would also tie up too much capital on the TSLA trade (over $2000 of capital per contract). So what else could we do? We decided to look at buying the July 230/210 put spread for $7.45.

This trade had us buying the July 230 put and at the same time selling the 210 put. We paid $7.45 or $745 per spread. We still controlled 100 shares of TSLA stock on the downside but by using the put spread instead of buying the long put we were able to cut our cost by over 50%. This is still a bearish trade so we make money if the stock moves lower. Our risk is limited to the price that we paid for the spread which was $745 per spread. The trade off here is we will be left with a smaller winner if the trade does hit the target on the chart.

In our example, the trade did go down and hit full target on the chart at $212.86. Once this level was hit, we closed the trade by selling the put spread for $11.90. This gave us a profit of $445 per spread or a 60% return.

Here is a great example of using options to open the door to some of the expensive tech stocks for a fraction of the price. Don’t feel like you are backed into a corner trading the cheap stocks because you have a small account size. Use the long vertical spread to go where the action is without tying up thousands of dollars of capital.

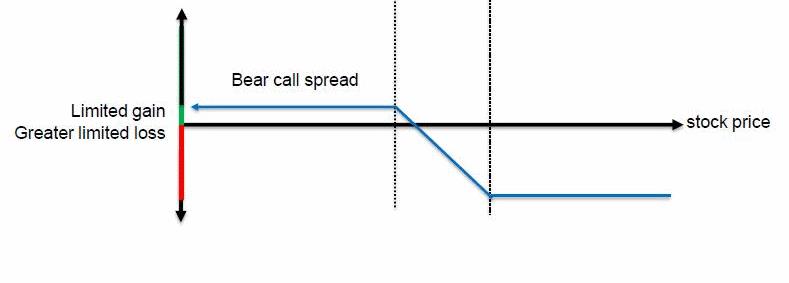

Short Vertical Spread

Trading long calls and puts or a long vertical spread give us great ways to put on an aggressive trade when we have a strong opinion on market direction in the near term. What if we are a little less certain of market direction? Selling vertical spreads to open a position can give us a way of scratching out a profit even in a period of choppy price action. We do this by selling an option that is closer to the current price of the stock and then going out and buying an option with a strike price that is farther out of the money. By doing this, we are still able to be in a risk defined position but it also gives us multiple ways of being profitable. Let’s take a look at the criteria that we use when selling a vertical spread to open a position.

When selling vertical spreads to open a trade we still like to use options with between 20-40 days left until expiration. Why do we prefer to go out farther in time? In most cases the monthly options will have more volume and open interest when compared to the weekly options. This will make them easier to get in and out of trades at good prices.

Going out to the monthly options will also give us more time to be right just in case the market moves against us initially. This gives us time to recover while the weekly options don’t give us that flexibility.

When selling spreads, we like to collect as close to 40% of the width of the spread as possible. For example, back in early June we saw that the Real Estate ETF (Symbol: IYR) was overbought and we felt it was due for a pullback. However, I was less sure on the timing of the move and didn’t want to be super aggressive by buying a put or put spread. Instead, I wanted a trade that would make money if IYR moved lower or got choppy.

We went out to the July monthly options and we sold the July 80.5/81.5 call spread to open the position. This had us selling the 80.5 call and buying the 81.5 call at the same time to make it a risk defined trade. We collected $.38 or $38 per spread to put this trade on. This $38 was the most we could have made on the trade, while our risk was limited to $62 per spread (difference between the 81.5 and 80.5 strikes minus the $.38 collected to put the trade on). Our break even point on this trade was at $80.88 (short 80.5 call plus the $.38 collected to put the trade on).

Why would we risk $60 to make $40? That doesn’t sound like a very good risk to reward ratio. The reason we would like a trade like this is it would allow us to make money 5 different ways:

- We make money if IYR moves slightly higher as long as price closes below $80.88

- We make money if IYR moves lower as long as price closes below $80.88.

- We make money if IYR moves sideways as long as price closes below $80.88.

- We make money as the time decay adds up each day that we hold the trade.

- We make money if the implied volatility contracts.

In our case, we were fortunate that IYR did move lower, time decay did add up, and volatility decreased. As a result, we were able to close this trade out by buying the spread back for $.12 or $12 per spread. This gave us a profit of $26 per spread. While that doesn’t seem like a lot of profit, remember we only tied up $62 of capital to begin with. You could have put this trade on 10 times and still had less than $650 of capital at work.

It’s important to note that the criteria outlined above is the same for both short call spreads and put spreads. By having a rule set in place, it allows us to be more consistent and eliminate much of the discretionary decisions that so many retail trades get stuck on.

Selling vertical spreads to open positions is a very powerful approach that many retail traders miss out on. While short spreads are not the holy grail of trading, they give us the flexibility that we need to make money in any type of market condition that comes our way.

Risk Management - Position Sizing

Now that we have 3 options strategies that we can use to take trades right away, the next step is to determine how much risk we can take. One of the biggest reasons for traders failing to reach their profit goals is taking position sizes that are way too big. I hear it all the time from newer students. “If I just hit a few big winners the whole game changes for me.” The approach is completely backwards thinking. When trading with a small account size it’s crucial to focus on consistent growth over time. If you can focus on small winners on a regular basis you will see the power of compounding take over.

I would also much rather see a newer trader take 5-6 small positions instead of 1-2 big positions. With any trading system out there the statistics become more significant as the sample set of trades becomes larger. If you are just taking 1 or 2 trades at a time, it becomes a long shot to see the results you are looking for. However, if you are taking 5-6 trades now all the sudden we can get more diversification built in and also build our sample set of trades larger to make sure the odds are in our favor.

Having a risk management rule in place is crucial to trading success. I have included a sample risk management template below. This is a very similar plan that I use in my own trading.

Sample Risk Template:

Determine what % of your account size you are willing to have at risk.

In my plan I use the 50% number. This rule says I will not have more than 50% of my account size at risk at any one time. If I am using a $10,000 account this means I can’t have more than $5,000 at risk across all my different positions. So I have $5,000 to work with spread across the 10 names on my watch list. If I reach that $5,000 limit and I get new trades to set up, then I need to either close out of some existing trades to free up capital in order to get back below the $5,000 level or skip the trade.

The 50% number works for me and is a level I am comfortable with. That number could be different for you. It could be 25% or 60%. The number doesn’t matter to me as long as you are comfortable with that level of risk and it’s something you can stay disciplined to following.

Initially, you will want to try and keep the risk spread evenly across all the names on your list. Don’t let one name on your list dominate your P/L. For example, trading one contract on GOOGL is not the same as trading one contract on C. In this case the outcome of the GOOGL trade will dominate your P/L.

The risk doesn’t have to be equal to the penny across all your trades but don’t let it get too far out of line. Overweighting certain sectors from time to time will work fine as long as you are comfortable with the risk. Never get into the situation where the outcome of one trade impacts your ability to take the next trade. Remember, we are looking for consistent long term success with our trading.

What’s the takeaway?

As traders we want to be as diversified as possible. This means a diversified list of products on our watch list, but also a diversified list of trade types as well. We all love to trade the long calls and puts as they give us a ton of profit potential quickly on any big market move. However, we also have to realize that the market doesn’t always move for us. So we want to make sure we have safer trades on like a short vertical spread which will allow us to make money if the market stays slow and sideways. Don’t limit your trading to the basic strategies just because you are working with a small account size. There are great trades that you can place with very little capital that will allow you to stay active in all market conditions. The more you mix up your trade types the more consistency you will see in your results long term.

THE SPECIAL OFFER

FREE Crash Proof Options Training Includes...

- Pinpoint Trade Accuracy: Always know the best option contract to choose in your trade

- How you can Protect your assets and grow your trading account

- How to succeed in all market conditions - whether the markets crash, continue higher or go sideways

Click here to get your "Crash Proof Options" survival guide

ABOUT THE AUTHOR