By Ananya Mariam Rajesh and Jessica DiNapoli (Reuters) – Procter & Gamble raised its annual profit forecast on lower commodity costs and as consumers, particularly in the United States and Europe, kept buying its pricey Tide detergent and Dawn dish soap. Even though P&G’s third-quarter net sales fell short of analysts’ expectations, the company has […]

Stocks end near flat as investors assess earnings, data

By Chuck Mikolajczak NEW YORK (Reuters) -U.S. stocks closed near the unchanged mark on Thursday, as investors sifted through the latest corporate earnings, while economic data and comments from Federal Reserve officials suggested the central bank was unlikely to cut interest rates in the near future. Economic data showed that the labor market remained resilient, […]

Boeing’s safety culture under fire at US Senate hearings

By Allison Lampert and Abhijith Ganapavaram (Reuters) -Boeing’s safety culture and manufacturing quality, both at the center of a corporate crisis following a January mid-air panel blowout on a near-new 737 MAX 9, were scrutinized on Wednesday in two U.S. Senate hearings. Testimony at the U.S. Senate Permanent Subcommittee on Investigations raised questions about Boeing’s […]

Toyota recalls Prius cars due to door handle fault

(This April 17 story has been officially corrected after Toyota clarified it incorrectly stated customer orders for the Prius model had been suspended, in the the headline and paragraph 1) TOKYO (Reuters) – Toyota Motor has recalled more than 135,000 Prius hybrid cars in Japan due to a problem with rear door handles. The cars […]

US stocks end down, crude slides amid Fed, geopolitical crosscurrents

By Stephen Culp NEW YORK (Reuters) -U.S. stocks closed lower on Wednesday as crude prices tumbled and investors weighed cautious U.S. Federal Reserve commentary and ongoing geopolitical strife against mixed quarterly earnings. Benchmark U.S. Treasury yields and the dollar eased back from multi-month highs, while gold backed down from its all-time high. All three major […]

Bank of America profit hurt by losses on credit cards, office loans

By Saeed Azhar and Mehnaz Yasmin NEW YORK (Reuters) -Bank of America shares on Tuesday fell more than 3% after its first-quarter profits shrank and the bank set aside more money to cover souring loans from consumers whose finances are worsening. U.S. lenders have cited resilient household finances as evidence that the economy remains on […]

US stocks tumble as Treasury yields rise, Middle East tensions simmer

By Stephen Culp NEW YORK (Reuters) -Wall Street ended sharply lower on Monday amid rising U.S. Treasury yields as simmering tensions in the Middle East helped curb investor risk appetite. The three major U.S. stock indexes reversed initial gains to extend Friday’s sell-off, while the yen fell to its lowest level in 34 years, reviving […]

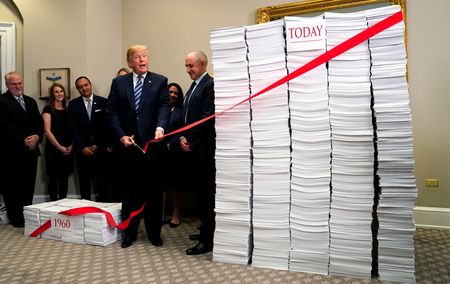

If Trump wins, he plans to free Wall Street from “burdensome regulations”

By Lawrence Delevingne and Douglas Gillison WASHINGTON (Reuters) – A second Trump White House would seek to sharply reduce the power of U.S. financial regulators, according to a review of public documents and interviews with people allied with the former president. In the wake of the worst economic crisis since the Great Depression, Congress dramatically […]

Newsletter

P&G lifts annual profit forecast on strong US consumer demand, easing costs

April 19, 2024

By Ananya Mariam Rajesh and Jessica DiNapoli (Reuters) – Procter & Gamble raised its annual profit forecast on lower commodity costs and as consumers, particularly in the United States and Europe, kept buying its pricey Tide detergent and Dawn dish soap. Even though P&G’s third-quarter net sales fell short of analysts’ expectations, the company has […]

Read More