By Allison Lampert and Abhijith Ganapavaram (Reuters) -Boeing’s safety culture and manufacturing quality, both at the center of a corporate crisis following a January mid-air panel blowout on a near-new 737 MAX 9, were scrutinized on Wednesday in two U.S. Senate hearings. Testimony at the U.S. Senate Permanent Subcommittee on Investigations raised questions about Boeing’s […]

Toyota recalls Prius cars due to door handle fault

(This April 17 story has been officially corrected after Toyota clarified it incorrectly stated customer orders for the Prius model had been suspended, in the the headline and paragraph 1) TOKYO (Reuters) – Toyota Motor has recalled more than 135,000 Prius hybrid cars in Japan due to a problem with rear door handles. The cars […]

US stocks end down, crude slides amid Fed, geopolitical crosscurrents

By Stephen Culp NEW YORK (Reuters) -U.S. stocks closed lower on Wednesday as crude prices tumbled and investors weighed cautious U.S. Federal Reserve commentary and ongoing geopolitical strife against mixed quarterly earnings. Benchmark U.S. Treasury yields and the dollar eased back from multi-month highs, while gold backed down from its all-time high. All three major […]

Bank of America profit hurt by losses on credit cards, office loans

By Saeed Azhar and Mehnaz Yasmin NEW YORK (Reuters) -Bank of America shares on Tuesday fell more than 3% after its first-quarter profits shrank and the bank set aside more money to cover souring loans from consumers whose finances are worsening. U.S. lenders have cited resilient household finances as evidence that the economy remains on […]

US stocks tumble as Treasury yields rise, Middle East tensions simmer

By Stephen Culp NEW YORK (Reuters) -Wall Street ended sharply lower on Monday amid rising U.S. Treasury yields as simmering tensions in the Middle East helped curb investor risk appetite. The three major U.S. stock indexes reversed initial gains to extend Friday’s sell-off, while the yen fell to its lowest level in 34 years, reviving […]

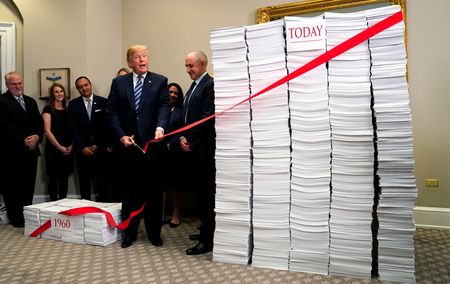

If Trump wins, he plans to free Wall Street from “burdensome regulations”

By Lawrence Delevingne and Douglas Gillison WASHINGTON (Reuters) – A second Trump White House would seek to sharply reduce the power of U.S. financial regulators, according to a review of public documents and interviews with people allied with the former president. In the wake of the worst economic crisis since the Great Depression, Congress dramatically […]

US Treasury warns creditors against free-riding on aid to developing countries

By Andrea Shalal WASHINGTON (Reuters) -A top U.S. Treasury official on Thursday called out emerging official creditors – the biggest of which is China – for curtailing loans to countries that had already embarked on a program with the IMF or multilateral development banks. “When the IMF and MDBs support countries’ reforms and investment plans, […]

Macy’s adds two directors to settle with Arkhouse; carries on with deal talks

(Reuters) -Macy’s ended a nearly two-months long proxy contest with Arkhouse Management by adding two of the activist investor’s nominees to its board, the U.S department store chain said on Wednesday. The retailer also said it continues to engage with Arkhouse and Brigade Capital Management over their revised buyout proposal. In March, Arkhouse and Brigade […]

Newsletter

Boeing’s safety culture under fire at US Senate hearings

April 18, 2024

By Allison Lampert and Abhijith Ganapavaram (Reuters) -Boeing’s safety culture and manufacturing quality, both at the center of a corporate crisis following a January mid-air panel blowout on a near-new 737 MAX 9, were scrutinized on Wednesday in two U.S. Senate hearings. Testimony at the U.S. Senate Permanent Subcommittee on Investigations raised questions about Boeing’s […]

Read More